In the United States of America the amount of student loan debt has increased significantly. At that moment, the student loan debts are on the second place in credit provision ranking after mortgage services. This index has reached a record value. At that moment, the total amount of student debts to financial institutions of the state is $1.2 trillion. This amount has increased on 84% since the end of 2008. The average amount of debt is nearly $29400. These data are recorded with famous research center Experian.

The most problematic regions in this area are Louisiana, Oklahoma and Mississippi. This is the place where experts fixed the largest educational loan delinquency. It is worth to note that in the United States the most part of these loans must be repaid (61%), while the other part (39%) is in deferment. It means that borrowers are not obligated to pay money during the training period, or being in the unemployed status. However, quite often the interest rates increase in these periods, and it means that the person will have to pay more money on the loan, even in a later date.

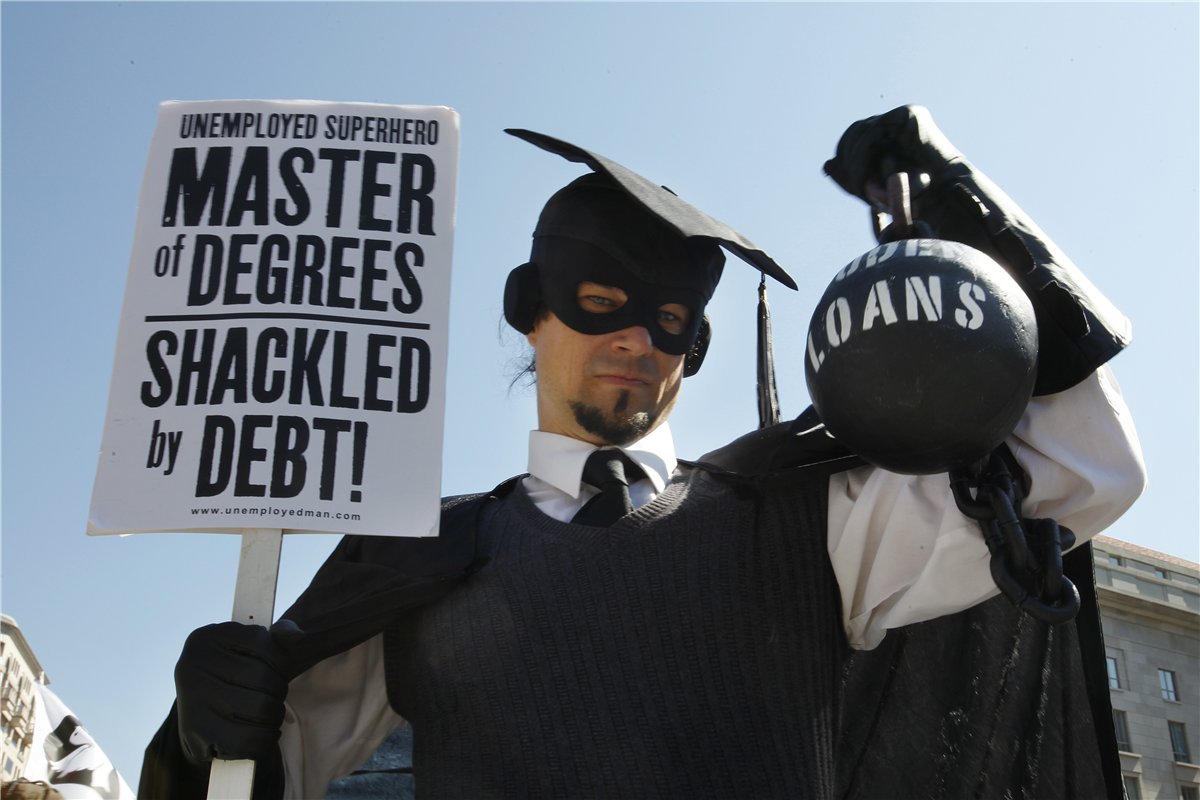

Such a difficult situation with student educational lending has a negative impact on the whole US economy. At that moment, these student loan debts are the cause of social inequality between the rich population of the state and all the rest.

If the university graduate begins immediately to improve its welfare by investing in real estate, stocks, bonds, he will be able to see the growth of his capital with a smile. However, this prospect does not shine to students with credit debts. They do not have this opportunity. It is worth to mention that in average, loan for university studies is paid during 10 years in the USA.

26.09.2014 | World News